Tax scams can happen anytime of the year, not just during tax season. However with less than 2 months remaining prior the tax return deadline on October 31st, email scammers are as active as ever.

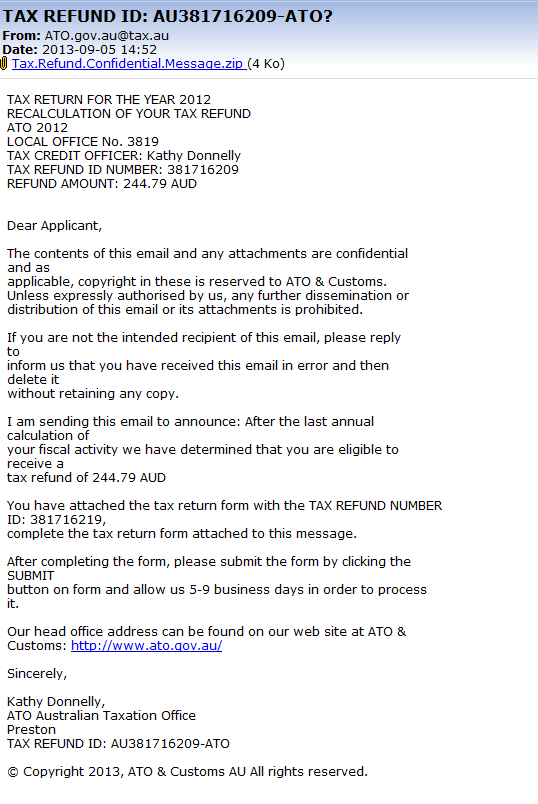

The Australian Taxation Office (ATO) has warned people about official-looking phishing emails that circulate either offering recipients a tax refund if they fill out an online form or claiming a tax refund has failed to process.

"Get your tax refunds now" scam

If you haven't lodge your taxes yet, similar email subject lines have a strong potential to capture your attention. Be careful. Generally, such emails will link to a bogus ATO website asking for your personal and credit card details. As a rule of thumb, none of official Australian institutions, ATO included, will ever send out emails to taxpayers asking them to provide personal information.

Other version of the same scam could contain an attachment infected with a virus. Clicking on attached message could infect your computer with malicious software that can monitor web browsing and steal personal information. "If you receive an email like this do not open the attachment", the ATO has warned.

"Your Tax refund has failed to process" scam

The latest tax email scam targets people who might have already lodged their taxes for 2012. It claims a credit card number on file is out of date so a refund could not be processed. It then directs you to click on a link which leads to a bogus Australian Government site where your credit card details can be updated. Fake credit card details update form could also ask for other identity information, such as date of birth, mother's maiden name, Medicare or your tax file numbers. Again, don't lower your guard to scams. Under no circumstances ATO will ask you to provide, confirm, update or disclose your personal information via email.

Quick tips how to identify a tax email scam

- Delete emails offering a tax refunds

- Delete emails requesting to confirm or update any personal details

- Delete emails asking for credit card and PIN numbers

- Verify if the sender is genuine: email should always come from a valid ATO email address.

- Watch out for tell-tale signs – whilst the sender may claim to be from an official source, their email may contain spelling mistakes or use poor grammar.

- If in doubt: liaise with tax office via details provided on their official website:

http://www.ato.gov.au/About-ATO/About-us/Contact-us/

Examples of ATO Tax Scams

Below are some examples of refund scam emails:

Have you received any ATO tax scams? Report it to SCAMWatch: scamwatch.gov.au.